- Company

- Case Studies

- Industries Transformation ELearningEducation Software Development ServicesFintechFinancial Software Development ServicesLogistics and TransportationLogistics and Transportation Software Development ServicesHealthcareHealthcare Software Development ServicesInsuranceInsurance Development Services

- Blog

- Schedule a Call

- Company

- Case Studies

- Industries Transformation ELearningEducation Software Development ServicesFintechFinancial Software Development ServicesLogistics and TransportationLogistics and Transportation Software Development ServicesHealthcareHealthcare Software Development ServicesInsuranceInsurance Development Services

- Blog

- Schedule a Call

Industries Transformation

ELearning

Education Software Development Services

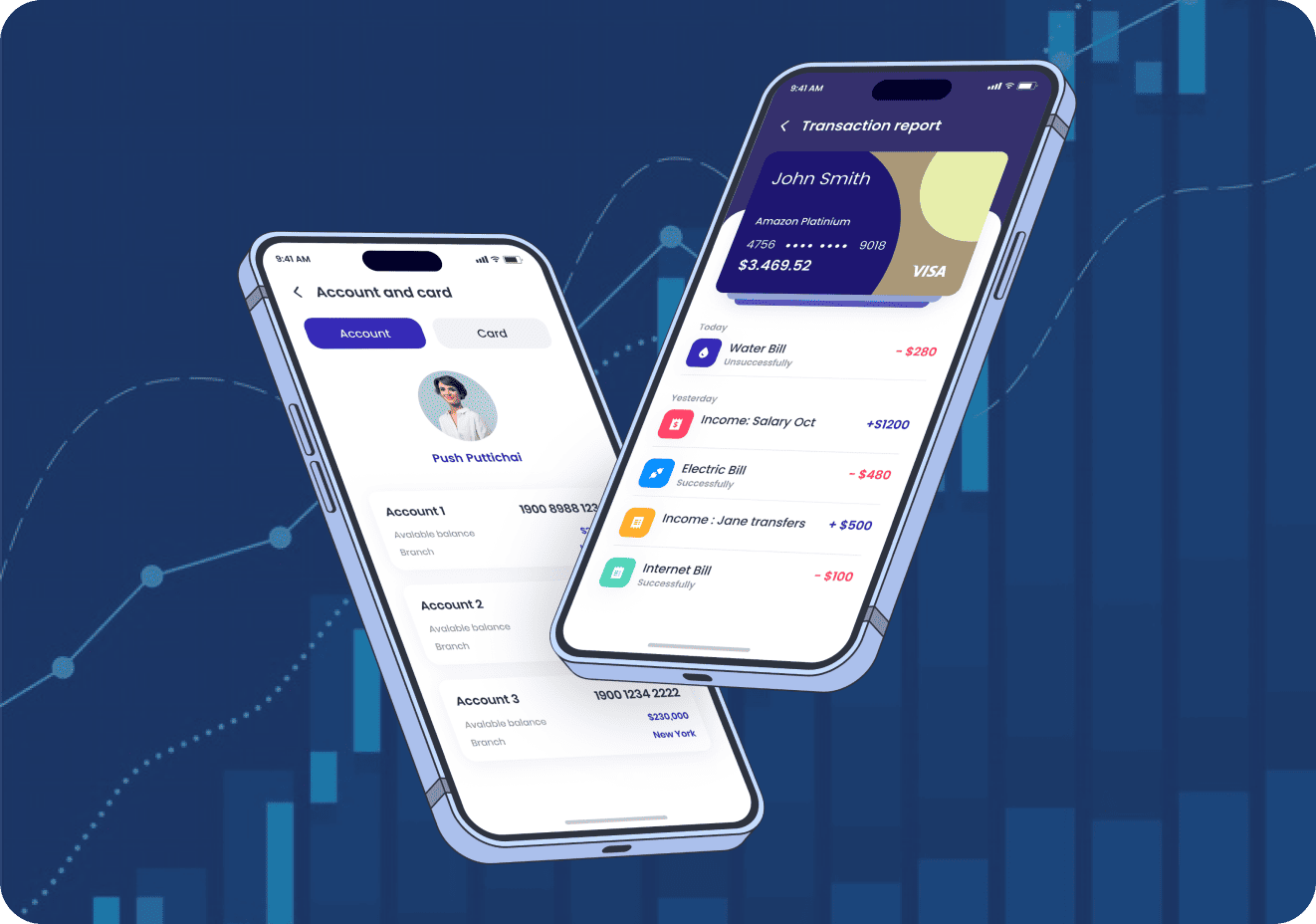

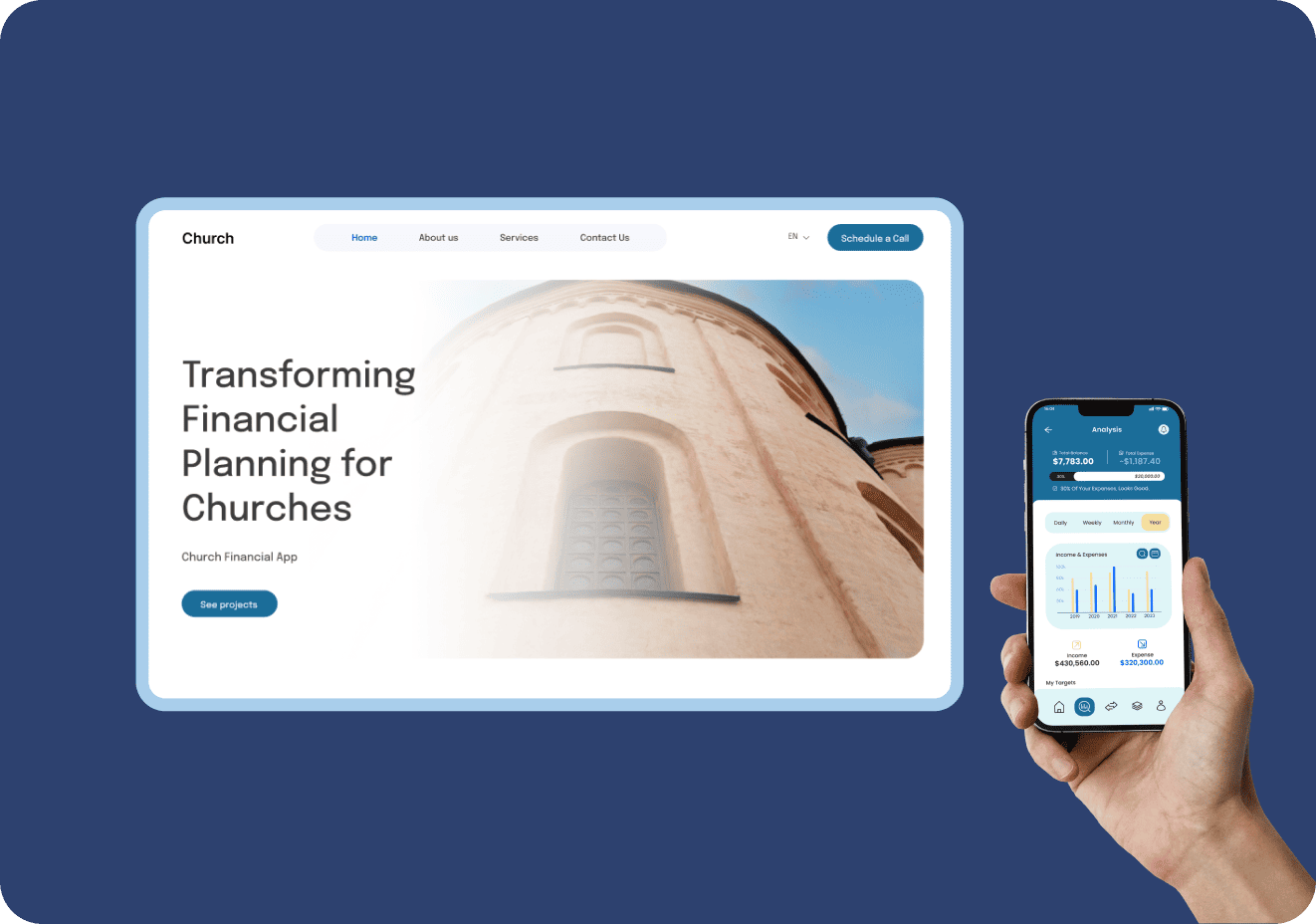

Fintech

Financial Software Development Services

Logistics and Transportation

Logistics and Transportation Software Development Services

Healthcare

Healthcare Software Development Services

Company