Mobile Insurance Apps & Chatbots

We build native and cross-platform mobile insurance apps and AI-powered chatbots that streamline policy access, claim filing, and communication. These solutions improve customer engagement, reduce pressure on service teams, and allow businesses to offer 24/7 assistance. From push notifications to secure document uploads, every feature is built for convenience, helping insurers stay connected with policyholders wherever they are.

Claims & Policy Management Software

Our insurance software development services include building platforms that automate claims processing and streamline policy administration. With features like case tracking, document uploads, automated approvals, and compliance controls, claims management software reduces manual effort, minimizes errors, and supports regulatory compliance. It also provides real-time reporting and intuitive dashboards, helping teams manage large volumes of data more easily.

AI-Powered Underwriting & Risk Assessment

TechVision develops AI-powered solutions that streamline underwriting and risk assessment. By analyzing complex datasets from multiple sources, our models identify patterns in customer profiles, claim histories, and external factors to predict risk more accurately. This accelerates the underwriting process, improves pricing precision, and reduces manual overhead, enabling insurers to operate more efficiently and make better-informed decisions.

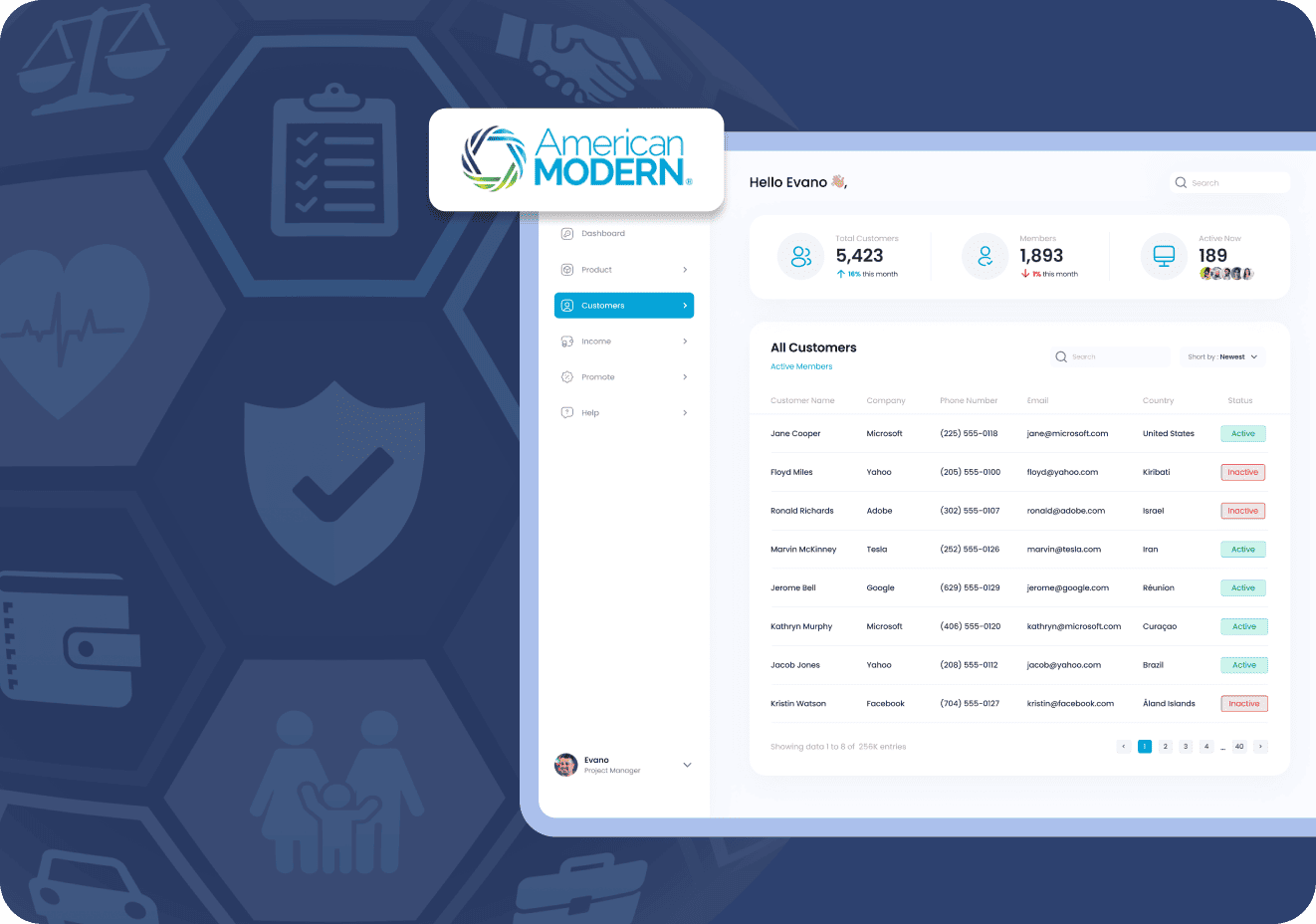

Insurance Quoting Software

You can entrust us with creating reliable quoting software that calculates premium payments based on real-time data, risk models, and predefined rules. The systems we build support instant comparisons, multi-product bundling, and lead generation workflows. As a result, teams can reduce manual workload and focus on high-value activities like customer advising or underwriting review.

Customer Portals & Self-Service Platforms

Our self-service solutions allow policyholders to view coverage, update personal details, pay premiums, and submit claims without contacting support. These portals reduce administrative load and enable 24/7 access to essential insurance services while secure authentication and mobile responsiveness provide smooth user experiences. By leveraging this type of insurance software solution, companies can enhance customer satisfaction and lower operational costs.

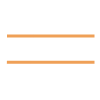

CRM & Customer Experience Solutions

We build CRM platforms tailored to the insurance sector, helping teams manage client relationships, track communications, and run targeted campaigns. Integration with claims, policy, and billing systems provides a unified view of each customer. With better segmentation and automated workflows, insurers can improve retention, increase upsell opportunities, and deliver consistent experiences across channels.

Legacy System Modernization & API Integration

TechVision provides assistance with updating outdated infrastructure by refactoring legacy systems and connecting them to modern platforms through secure APIs. This reduces technical debt, improves maintainability, and supports the adoption of new tools. We offer a modular approach so that you can modernize at your own pace while extending the life of critical applications.

Data Analytics & Business Intelligence

If you're looking to make faster, more informed decisions, TechVision can help. We deliver insurance data analytics platforms that turn claims trends, customer behavior, fraud patterns, performance metrics, and other key data into actionable insights. Custom reporting tools, data visualizations, and automated alerts make these solutions indispensable for effective risk management and strategic planning.

Usage-Based Insurance & Telematics Solutions

We design telematics systems and UBI platforms that gather behavioral or sensor data to support dynamic pricing models. Through vehicle tracking, mobile sensors, or wearable data, insurance companies can offer fairer premiums based on actual usage or risk profiles. These solutions promote safer behavior, reduce fraudulent claims, and open new product lines like pay-per-mile or pay-how-you-drive coverage.